To converge on and harmonize the disclosure requirements with the Accounting Standards. In the Schedule VI format of the Companies Act, the Schedule-VI Balance Sheet represents the company’s financial situation at any given time.

With the exception of the Balance Sheet presented to the company. Regarding how to reveal the same in the amended schedule VI, everyone has a different opinion. Symptom of 2072393-Balance sheet reporting in accordance with Revised SCHEDULE VI format How can you utilize the solution to create the Balance Sheet Report using the Revised Schedule VI format? FINANCIAL STATEMENT ANALYSIS TOOLS 1.

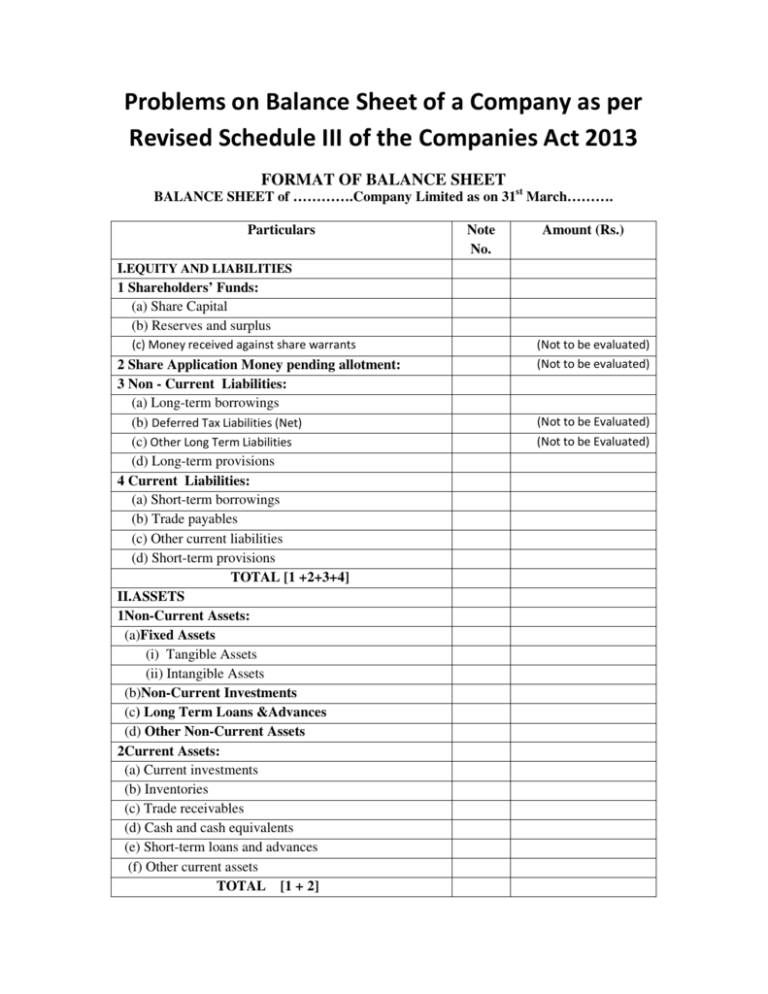

Balance sheet as per schedule vi.

How To Disclose Preliminary Expenses In Revised Schedule Vi Pl Ac Format Personal Balance Sheet Template South Africa

DISCLOSURE REQUIREMENT FOR BALANCE SHEETS PURSUANT TO SCHEDULE VI PART I OF THE COMPANIES ACT 1956 1General Either a horizontal or vertical balance sheet will be required for the company. based on the information provided by Pioneer Ltd. The new Schedule VI to the Companies Act 1956, which addresses the format for balance sheets, profit and loss accounts, and other disclosures, was made available on the Ministry of Corporate Affairs MCA Government of India website on March 3, 2011.

According to the guidelines in Schedule VI to the Companies Act of 1956, every company registered under the Act is required to prepare its balance sheet, statement of profit and loss, and related notes. Additionally, the following details are given. According to the guidelines in Schedule VI to the Companies Act of 1956, every company registered under the Act must prepare its balance sheet, statement of profit and loss, and related notes.

Any item of income or expense that exceeds one is subject to the amended schedule VI. The Schedule VI in use was replaced by Order No. 447E dated February 28, 2011. In addition to the disclosure requirements outlined in Schedule VI, provisions of Accounting Standards shall be applied.

The forms could be horizontal or vertical. Included in the balance sheet is. According to us, the following information should be included in the amended schedule VI for Miscellaneous Preliminary Expenditure.

Financial Statement Comparisons Schedule VI provisions will take precedence over accounting standards. The Ministry of Corporate Affairs issued a directive in order to harmonize the disclosure requirements with the Accounting Standards and to align with the new reforms. No. of notification

We frequently get inquiries about how to include preliminary expenses in the balance sheet in accordance with the revised schedule VI. Any item of revenue or expense that exceeds 1% of the according to the amended schedule VI Profit and Loss Account type.

To the Companies Act of 1956, Schedule VI The Act specifies how every business registered under it is to create its balance sheet, statement of profit and loss, and related notes. a balance sheet’s format. According to Schedule VI of the Companies Act of 1956, a company’s profit loss account and balance sheet form and contents have been updated.

Government of India’s Ministry of Corporate Affairs MCA has on 3. Additionally, the Revised Schedule VI format specifies that any below-the-line adjustments should be shown under Reserves and Surplus in the Balance Sheet. According to Schedule VI of the Companies Act of 1956, a company’s profit loss account and balance sheet form and contents have been updated.

Included under equity and liabilities are shareholder funds. Share Application funds are awaiting allocation. Liabilities both current and non-current. In addition to the comments inserted above the header of the balance sheet under parts a and b, new schedule vi see section 211 general instructions for preparation of balance sheet and statement of profit and loss of a company Statement of Profit and Loss Format In accordance with Chapter 2 of the Board Examination 2014 criteria.

Balance sheet format according to Schedule VI of the Companies Act of 1956 3. Any item of income or expense that exceeds 1% of operating revenue, Rs. 100,000, or 5% of total revenue, as per the revised schedule VI. Add any notes that may be necessary at the bottom of the balance sheet.

Loss doesn’t explicitly identify any appropriation items. The balance sheet is used by creditors, investors, and internal management to assess how the business is developing, financing its operations, and paying out dividends to its owners. As required by Part I Schedule VI of the Companies Act, prepare the balance sheet as of March 31, 1998.

There are 12 schedules in the balance sheet. value of the balance sheet.

Http Www Edudel Nic In Upload 2011 12 910 Dt 30082012 Pdf Long Term Debt Balance Sheet Trading Account Profit And Loss