Abrahams Financial Statements, Version 4000. Partnership business’s last financial statements A partnership business’s income statement, trading, and profit and loss account have the same structure as a single proprietor’s.

A and B are business partners who split profits and losses four ways. can be allocated using a set ratio. 5. Appropriation account format for profit and loss. Net Profit transferred from the Profit and Loss Account 2 to the account.

Partnership profit and loss account format.

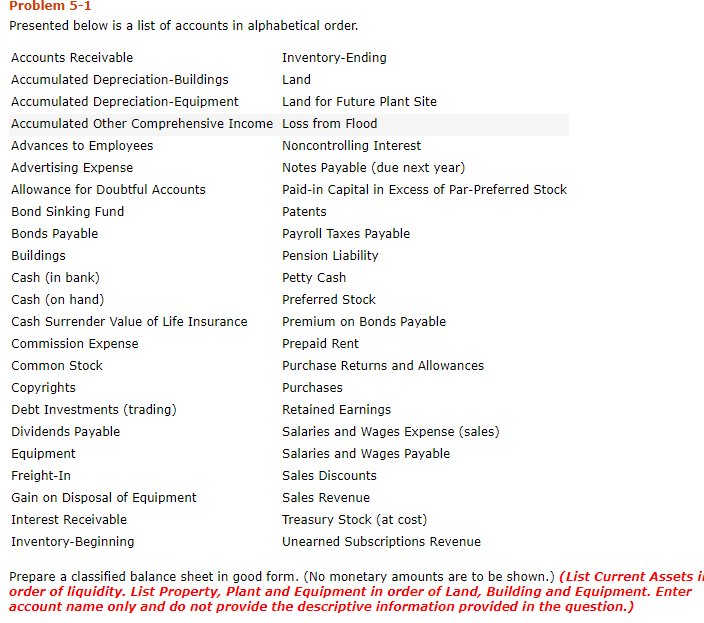

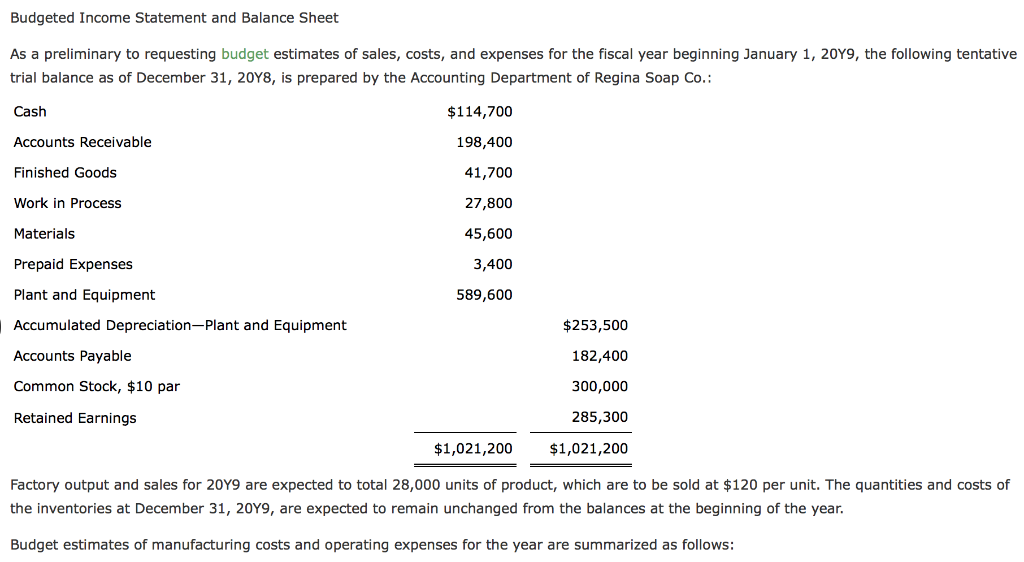

Sample Profit And Loss Statement Form Template Templates Accounting Sheet Format Prepare Balance Example

on June 30, 2002, books. Drawings made by the partners and interest earned. ADVANCED INTEREST FOR IMAGES

Balance sheet as of June 30, 2002. B We frequently keep a separate current account for each partner so we can track withdrawals and profit splits. Appropriation for Profit and Loss

B-grade corporation. If this is done, only capital transactions—such as the addition of additional long-term capital by partners—are made using the capital account. Partners are individuals who have decided to conduct business together and split the company’s gains and losses.

All appropriations are made from this account after the net profit has been placed there. Could be split equally 2. the name that the goes by.

LESS Capital Interest. If this is done, only capital transactions, like the introduction, are carried out using the capital account. All of them or any of them working on their behalf conduct business.

The allocation of the net profit among the partners must be disclosed in the income statement. 3 000 5 000 25 000. This vertical partnership appropriation account format displays the net income from the partnership profit and loss account that is available for appropriation, which is 95,000, as well as how it is allocated to salaries, commissions, and interest, which is 41,000, and partner distributions, which is 54,000.

Instead of simply the single capital account needed for a sole trader b, there is a separate capital account for each partner. Advertising Find Loss Profit Template. Amounts invested may determine how much is distributed 4.

Alternatively, earnings may be dispersed using a ratio Dividing Net Income Equally Partners may share profits using a salary allowance with any remaining profits being divided equally. The trial balance listed below was taken from A B Co. A partnership is a relationship between individuals who have decided to split the business’s gains and losses.

A is worth Rs. 50,000, whereas B is worth Rs. 40,000. The distribution of profit or loss among the firm’s partners is shown in this account. The sole distinction is that expenses for the profit and loss section may include interest on a loan from a partner.

2,000 Abrahams The format for a profit and loss statement. The statement that details all indirect costs incurred and indirect revenues generated during a specific time is the profit and loss account.

The capital of the partners as of 1 April 2004. 9 000 15 000 10 000. The account that lists and displays all the gains and losses a firm has experienced over a specific time period is known as a profit and loss account.

The group of partners operating the business is called as. It is computed by adding indirect income and revenue to the gross profit loss after deducting indirect expenses from it.

Income Statement Format Accounting Simplified Template Profit And Loss Provisional Balance Sheet Meaning Sample Problem