We prepare the profit and loss pending account for what reasons. Definition of a profit and loss account Profit and Loss Account refers to the account that displays a company’s annual net profit or net loss.

A financial statement called a profit and loss (PL) statement summarizes all of the revenues, expenditures, and expenses that were incurred for a given time period, usually a fiscal quarter or year. It is designed to learn the company’s Net Profitloss for the specific accounting period. Indirect expenses, losses, and gains are used to create the nominal account known as “profit and loss.” It is important to keep in mind that expenses incurred by the owner or partners should not be included in the profit and loss statement.

What is profit and loss account.

Profit And Loss Projection Template Fresh Business Plan Plans Underst Statement Financial Balance Sheet Of A Propietorship Old Schedule Vi Companies Act 1956

Locate the profit-and-loss statements. One of the two main statements is a profit and loss account, commonly known as a PL. The balance sheet, which is generated to assess a company’s condition and performance over a specific time frame, such as a month, quarter, or year, is the other. Carter All gains and losses are tallied in a profit and loss account to determine whether there are more gains than losses or vice versa.

Profit and loss account refers to the account used to calculate a company’s annual net profit or loss. This account is created in order to calculate a business concern’s net profit or loss for a given accounting period. Profit and Loss Accounts are a particular sort of financial statement that show the results of business operations over the course of an accounting period, i.e.

This is set up to determine whether the financial year under consideration had a net profit or loss. On a fundamental level, profit and loss are determined by subtracting costs from sales. the account for profit and loss.

During the year, it is utilized to report some false gains. A part of final accounts is the PL account. The Profit Loss Account is a component of the final financial statements created by a company entity to determine the net profit of the operations for a specific time period.

The two accounts’ respective functions are to show the company’s gross profit and net profit. It is computed by adding indirect income and revenue to the gross profit loss after deducting indirect expenses from it. Within the general ledger, the trading profit and loss account is composed of two distinct accounts.

As shown by the profit and loss statement. On a basic level, a profit and loss account, statement, or sheet is used to show you how much money your business makes or loses. The PL statement demonstrates a company’s capacity to drive sales, control costs, and make a profit.

In other words, you deduct the amount you were able to sell your items for from the cost of your goods. It is ready to calculate a trader’s net profit or loss. A financial report called a profit and loss statement (PL), income statement, or statement of operations gives an overview of a company’s revenues, expenses, and profits and losses for a specific time period.

Explain the goals and significance of PL Ac. The trading account, which sits atop the trading profit and loss account, is how the gross profit is calculated. What a profit and loss account is

The statement that details all indirect costs incurred and indirect revenues generated during a specific time is the profit and loss account. Trading accounts only display gross profits, whereas profit and loss accounts display net earnings for the business entity. This is how profit and loss accounts differ from trading accounts. The second component of final accounts is the profit and loss account.

A financial report called a profit and loss statement summarizes the income, costs, and expenses a business has for a given time period. Suspense Profit and Loss Account When a partner retires or passes away at any point before to the end of the reporting period, a business creates a profit and loss suspense account. A company’s trade account is used to assess its gross profit or loss, and its profit and loss account is used to calculate net profit after deducting all indirect expenses from the gross profit.

Consideration is given to reported earnings and outlays that are directly tied to an organization. The profit and loss account is typically created on a monthly, quarterly, or annual basis. The net profit and net loss of the company for the accounting period are shown in the profit and loss statement.

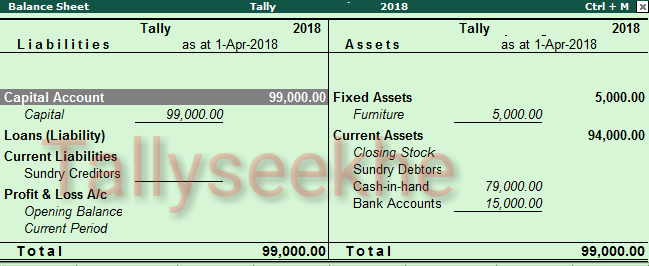

The Balance Sheet By Agatha Engel Template Financial Ratio Partnership Format In Excel C Corp