The liabilities of a firm are shown in a tax basis balance sheet at their true current value, providing the business paid for the liability right away. The Sales Use Tax Fuel Tax Bonds’ negative cash balance Riverboat gaming, financial institution tax, and county-other miscellaneous cigarette tax are all payable.

The accrual method is a different significant accounting technique. It is made up of taxes that must be paid to the government within a year. submit a tax return. The sales tax collected from customers on behalf of the overseeing tax authority is recorded in the balance sheet as a liability account called Sales Tax Payable.

Tax on balance sheet.

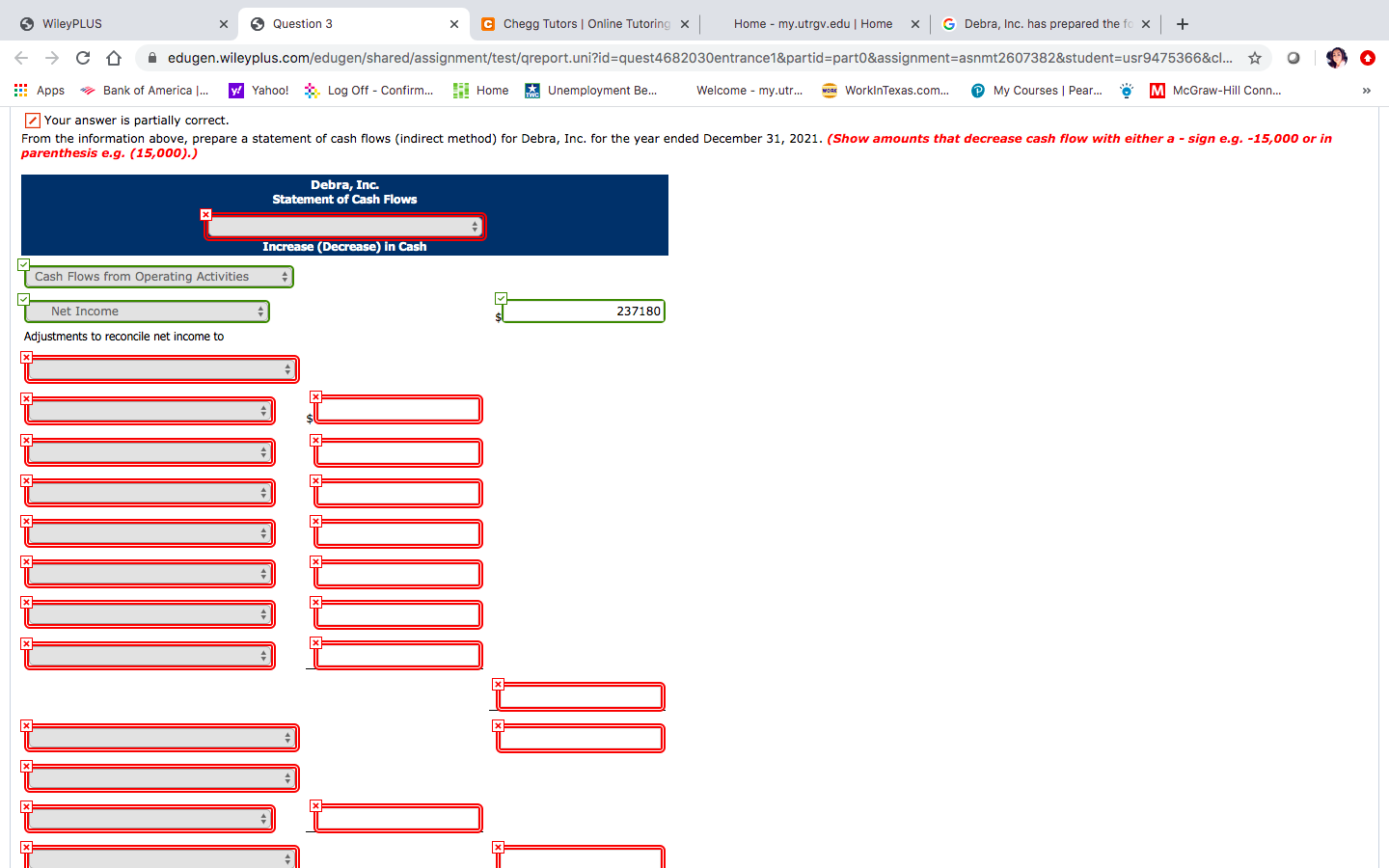

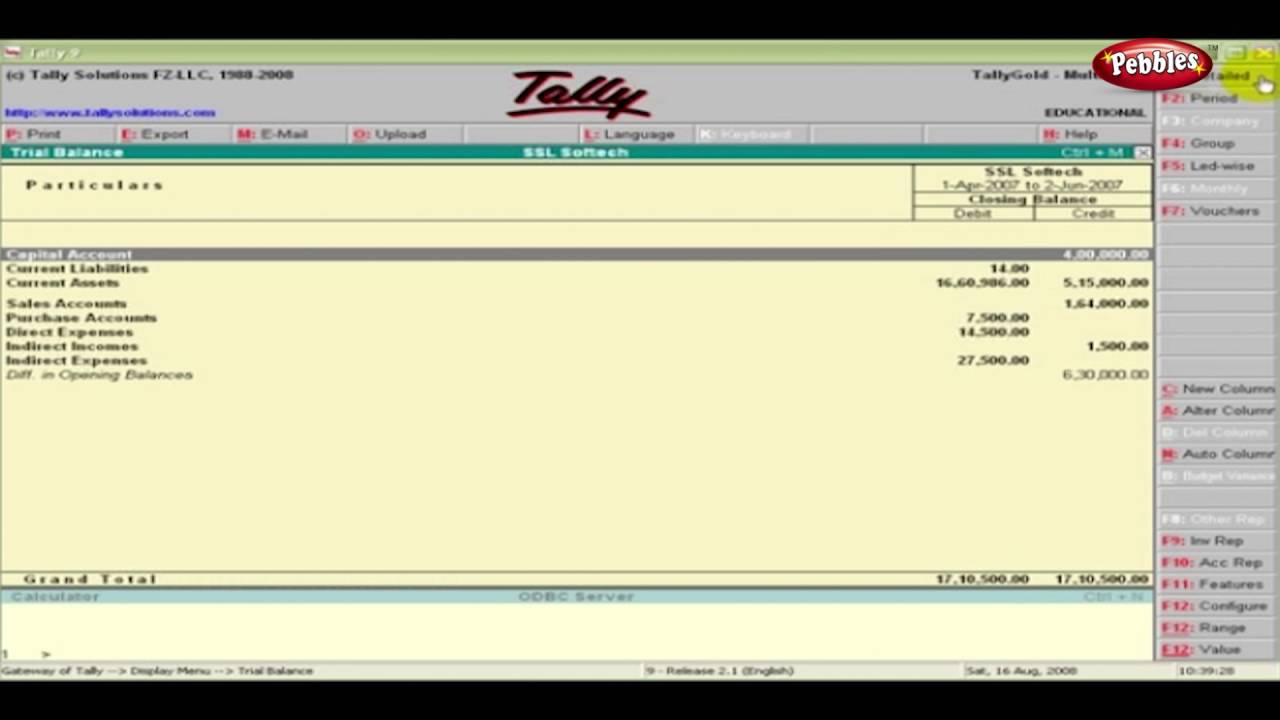

A Balance Sheet Example Accounting Career Template Sample With Defered Expenses Tally In Excel

Due to the fact that the income reported on the tax return and the income per book in the accounting records are different, deferred tax assets and liabilities exist. Balance sheet variation due to tax basis. According to tax laws Section 5 1 EStG, the tax balance sheet must be derived as a commercial balance sheet.

New GST Returns Using GST Software GST News GST Services GST Training GST Calendar. Business owners, accountants, and tax preparers can understand an organization’s assets, liabilities, and equity by using a balance sheet. Before deductions, total business income is less than $250,000.

If all of the following are true, you can skip the Balance Sheet section. A balance sheet, often known as a statement of financial status, concentrates on three different areas of your company. These transactions result in the balances of deferred tax assets and liabilities.

Rejoin Us What We Do Message Us Franchise Partner for a learning portal. A balance sheet is a record of a certain moment in time, typically at certain intervals during the year and at the end of the tax year. When filing income tax returns, a tax basis balance sheet also provides risk management advantages and simplifies the process of calculating income tax balances for auditors.

Each year, a tax balance sheet is created with the intention of assessing. This relevance principle is sometimes reversed in practice, with a balance sheet prepared with the expectation that it will be accepted by the tax office. The Development of Income Tax Accounting The tax basis balance sheet represents the tax basis of assets and liabilities in the same way that the financial statement balance sheet represents the book basis of assets and liabilities in line with GAAP.

The variance between the tax base balance sheet per is this. They are both directly compensated by the government and are based on the volume of goods or services sold. By definition, the balance sheet is a financial statement of the corporation that shows the monetary value recorded on each corporation’s records as of the first and last day of the tax year. All of the company’s debts are included in the assets. Liabilities, as well as the sum total of each individual’s share of the difference between assets and liabilities.

The filing of the tax return forms the basis for the tax basis balance sheet. Fuel tax and sales tax. A company’s balance sheet contains financial items called deferred tax assets and liabilities.

The liabilities of a firm are shown in a tax basis balance sheet at their true current value, providing the business paid for the liability right away. An account type included in the current liabilities part of a company’s balance sheet is income tax payable. Assets can be segmented on the balance sheet by category and have a quantifiable value.

Tax deductions for income Tax Verification of Income Information about e-filing ITRs for income tax refunds Put TDS returns in. taxation on income is calculated. Assets are assets that belong to your company, such as inventory, equipment, accounts receivable, and cash.

The company is responsible for timely remitting these payments to the government while keeping them in its possession. In consequence, this method of calculating tax liabilities allows businesses greater control over their tax accounting procedures and lays the groundwork for automating tax calculations. Typically, sales tax and use tax are shown as current liabilities on the balance sheet.

There is no Alabama Connecticut non-partnership filing for your company. Washington, D.C. Georgia Kentucky Louisiana Massachusetts Mississippi Partnership not in New Jersey USA North Carolina New York Oklahoma Pennsylvania.

Balance Sheets Free Sheet Template Quickbooks Trading And Profit Loss Account Questions