When cash dividends are paid, both the cash balance reported in the assets area of the balance sheet and the amount of retained earnings used to offset it in the equity section of the report are decreased. Examine financial statements such as the income statement and cash flow statement in addition to the balance sheet.

Year 1 balance sheet for Company X Balance Sheet for Year 2 of Company X Dividends declared in Years 3, 45, and 6 surpass net income. When dividends are paid, the company’s retained earnings and cash balance fall, which has an impact on the balance sheet. The balance sheet’s stated amount of retained earnings is decreased by paying the dividends. Because dividends can still be paid even during a cyclical decline in earnings, dividend safety is correlated with balance sheet health.

Dividend on balance sheet.

Ultimate Financial Ratios Spreadsheet For Dividend Investors 7 Ratio Balance Sheet And Pl Excel Rent Received Accounting Equation

Types of dividends and dividend payment methods, as well as dividend nature. On the balance sheet, cash dividends have an impact on two categories. Your accountant might be able to assist you with this.

Common stock dividends are not disclosed on. Despite having a negative balance sheet, my newest client has paid dividends this year. Dividends are the sum of money or other assets that a company typically pays to its shareholders as a fraction of its profits.

There is no net effect on the financial statements from merely setting aside money for a potential dividend payout. On the balance sheet, dividends that have been announced but not yet been paid are listed under current liabilities. It’s rather simple to determine dividend payments from a company’s financial sheet.

When a business makes money and accumulates retained earnings, those funds can either be put back into the business. A obligation on the balance sheet is represented by the credit entry to dividends payable. A portion of a company’s retained earnings is distributed to its shareholders.

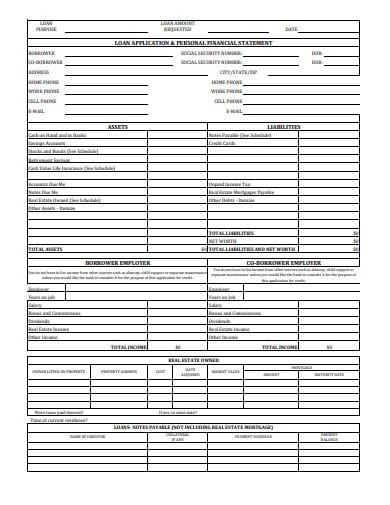

Write the dividends on the balance sheet under the Liability column after announcing your date. If you don’t have access to that document, though, you can determine the dividend amount using information from the income statement and balance sheet. In their routine investor filings, the majority of corporations list their dividends on a cash-flow statement or in a separate accounting summary.

Investors won’t discover a distinct balance sheet account for previously paid dividends. Furthermore, if the strength of that balance sheet is used to add assets that will increase earnings, the dividend cover can be increased over time. The retained earnings from the previous two years and the net income amount for the current year are all that an investor needs to know.

Where on the balance sheet are dividends displayed. As an illustration, a company that has 250000 outstanding shares distributes 1 dividend to each shareholder. Prior to dividend payments, the balance sheet is unaffected.

Only when a dividend has been declared but not yet paid is it included in the balance sheet; in this case, a dividend payable account is displayed under current liabilities as a debt owing to shareholders. It is shown in the income statement of the company. Dividends and a balance sheet that is negative a brief summary of the balance sheet with an emphasis on the money available for dividends.

On the balance sheet for the current and prior fiscal year, look for the entry titled Retained Earnings. Profits from a business can be used in one of two ways. Dividends can, however, be calculated.

The income statement will reveal a company’s profit or loss. The balance in the dividends payable account must be disclosed in the current liabilities section of the balance sheet if one is prepared between the date cash dividends are declared and the day stockholders are actually paid cash. A temporary equity account on the balance sheet is the dividends account.

A dividend is a portion of earnings that are kept after expenses. Retained Profits The total accumulated net income less all dividends given to shareholders is represented by the Retained Earnings formula. Defining a dividend The sum on the dividends account is moved to retained earnings; this is not an expense, but rather a distribution of retained earnings to the owners.

The sole obligations of the business are the accrual for my fees and the corporation tax obligation, both of which will be paid from the. A company’s dividend is regarded as an expense because it represents an appropriation of profit.

Ultimate Financial Ratios Spreadsheet For Dividend Investors 8 Ratio From The Following Information Prepare Trading And Profit Loss Account Of Ms Indian Sports Net Proft Equity Formula