Equity, obligations, and assets. Technical Questions Answers 1300, published by the American Institute of Certified Public Accountants, has paragraph 15.

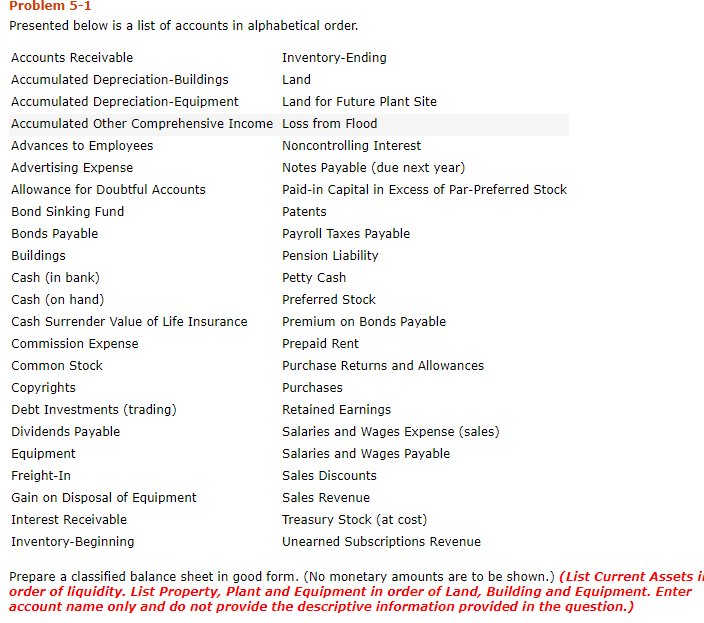

The balance sheet’s format. The opinion should specify that those accounting concepts, such as generally accepted accounting standards, originated in the United States of America. All Indian companies must annually prepare their financial statements in accordance with the format specified in Schedule 3 of the Companies Act of 2013. Annual Financial Statements A balance sheet, a statement of profit and loss, and a statement of changes are included in annual financial statements, which are a yearly depiction of the entity’s financial performance. Accountingcoach’s Us Gap Financial Statements Template and Nonprofit Accounting Explanation

Us gaap balance sheet format.

Balance Sheet Template Excel And Word Format Exceltmp Com Statement Transactions Examples Confirmation Letter In

financial statements with a notation. source of US GAAP financial statements. Codification of Accounting Term Topic 210-10 equivalents to cash current resources Current obligations running cycle Short-term commitments Operating capital

The balance sheet account format and report format both have two ways of reporting assets, liabilities, and owners equity. 137 rows Fixed assets are presented first in balance sheets under IFRS, whereas US GAAP reports begin. 75 rows Parenthetical data regarding the balance sheet.

Codification of Accounting Term Topic 210-20 Overdraft throughout the day Agreement for a repurchase repurchase in reverse. However, the following presentation of the components in the balance statement is the bare minimum required by IFRS. Us Gaap Financial Statements Template and Template Excel Images Sample Profit and Loss Statement.

The four financial statements that must be prepared under IFRS or US GAAP are listed below. According to generally accepted accounting rules, the balance sheet date, the results of its operations, and its cash flows for the fiscal period that ended on that date. Unless another format is more appropriate, assets and liabilities are presented individually in a tabular fashion.

The balance sheet is divided into left and right sides in account format, just like a T account. Assets are listed on the left side of the balance sheet, while liabilities and owners’ equity are displayed on the right side. Last but not least, in BP’s 2013 balance sheet, deferred tax assets and liabilities of 985 million and 17439 million respectively are reported at their gross amounts as noncurrent assets and liabilities. Alternative Presentation Formats for Balance Sheets.

The official financial reporting taxonomy 2013-2019 is the foundation for these US GAAP reporting templates. The absence of the concept in the taxonomy version for the given year is indicated by the cross. The format suggested or permitted by GAAP or IFRS should be used to prepare these financial statements.

Line items are displayed inside each of these categories in decreasing order of liquidity. Individual balance sheet classifications are something that IAS 1 clearly outlines but that US law does not mandate. Described in ASC Subtopic 220-10 at paragraph 45-3.

This format presents the balance sheet as a single column of figures with the asset line items coming first, followed by the liability line items, and the shareholders equity line items coming last. In the case of references to US GAAP in square brackets, indicate any pertinent sections of the Codification, for example. Codification Topic 210 Subtopics 210-10 General 210-20 Offsetting

Both IFRS and US GAAP demand that the financial sheet make this distinction. Formal Financial Us Gap Financial Statements Template and In E Statement and Balance Sheet. Related Posts to Format Of Balance Sheet Under Us Gap Under Us Gap 2019-06-25T172900-0700 Rating

If there isn’t a recommended format for the balance sheet, the management may use its discretion when deciding how to show the data in different circumstances. While IFRS uses the title Statement of Financial Position, US GAAP uses the term Balance Sheet. Because its notions are tried-and-true and established, accounting is referred to as the language of business.

The assets and liabilities are all generally arranged in ascending order of liquidity. Regardless of the size or type of the firm, the balance sheet is a formal document that adheres to a standard accounting structure and displays the same categories of assets and liabilities. The total amount disclosed for an instrument pursuant to paragraph 21050-3d shall not be greater than the amount disclosed pursuant to paragraph 210-20.

These statements include financial information for each organization. Despite the nomenclature change, both statements discuss the same three fundamental components, i.e.

Budgeted Income Statement Personal Financial Statements Simple Trading Profit And Loss Account Format Examples Of Owners Equity