The majority of accounting software contains a predefined chart of accounts. Profit or loss: 247 rows.

The names of all the accounts that a corporation has access to are listed in the chart of accounts. A financial report called a profit and loss statement (PL), income statement, or statement of operations gives an overview of a company’s revenues, expenses, and profits and losses for a specific time period. Profiling from the prior year brought forward. the title of.

Profit and loss account chart.

Profit And Loss Template 07 Statement Income Till Counting Sheet Balance Format Schedule 3

Earnings of the combined companies. This is a fantastic method to learn more about a specific options strategy before you take a position. The hypothetical profit is shown on the vertical Y-axis.

How does it function? It is designed to learn the company’s Net Profitloss for the specific accounting period. Income Status or PL Status Profit and Loss is referred to as PL.

The loss will be carried over. losses carried over from the prior fiscal year. Do you want to know how to modify your Profit and Loss using QuickBooks’ Chart of Accounts? Ever questioned where the namesaccount was?

In a chart of accounts, there are primarily two sorts of accounts. Clean up and add all required columns to the chart of accounts. Account Number will hunt for the same Account in the Chart of Accounts and return the Account Key; after that, play about with relationships; and lastly, produce a report. Account Key Index Description and so on. What Kinds of Accounts Are There in a COA Chart of Accounts?

Equity in unconsolidated profit and loss. The statement that details all indirect costs incurred and indirect revenues generated during a specific time is the profit and loss account. 96 rows of English-speaking managers in charge of international or French businesses.

To meet the demands of the business, it can be modified or expanded. The chart of accounts should be put up initially when switching to a new accounting system. When specific defined Profit or Loss requirements are satisfied, or at a predetermined time each day, the Global ProfitLoss Management tool is utilized to flattenclose all of the current Trade Positions for the presently open Charts or Trade DOMs for a Trade Account.

148 rows Example, Guide, and Key for a Chart of Accounts. Profit Loss on Disposition of Investments, 210 Closing Work in Progress: 269 270–275 Transactions FIXED ASSETS SALE 211 Gain on the Sale of Fixed Assets DIRECT COSTS: $281 to $299 Gain on Sale of Fixed Assets (212) Depreciation, 283 Loss on the Sale of Fixed Assets: 213 Freight Cartage, 286. The PL Profit Loss chart aids in visualizing the potential gains or losses of an option strategy at expiration.

How to run a Profit and Loss Report in QuickBooks Online for specific accounts from the Chart of Accounts. Excel’s profit and loss templates are simple to use and can be customized for any business in a matter of minutes with no accounting. It also contains distinct classifications for intercompany transactions and balances when used by a consolidated entity.

To determine your company’s profit by month or by year, as well as the % change from a prior period, simply enter revenue and costs into your statement of profit and loss form. It is computed by adding indirect income and revenue to the gross profit loss after deducting indirect expenses from it. Manufacturing, for instance, might require different codes than a retail establishment.

Both simulated trading and non-simulated trading can use this function. Benefit for income taxes provision. The PL statement demonstrates a company’s capacity to drive sales, control costs, and make a profit.

to the lawful reserves transfers. Contributions from shareholders in light of losses. combined revenue before taxes.

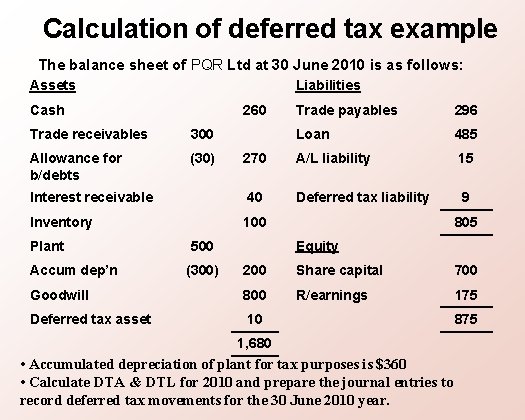

Chart of Accounts Example The balance sheet’s assets, liabilities, and equity as well as the classifications for profit and loss, income, expenses, gains, and losses are all included in a chart of accounts that complies with IFRS and/or US GAAP.

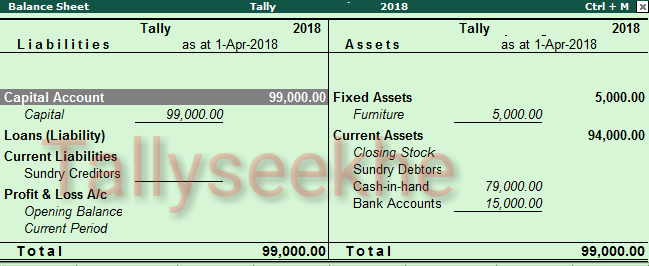

Profit And Loss Statement Template Doc Pdf Page 1 Of Dv6bnftx Income Deferred Credits Will Appear On The Balance Sheet With Format