Owner Equities and Liabilities are to be displayed on the right. As a result, an entity’s assets will always equal. Each debit therefore equals each credit. both the left and right sides. Assets minus liabilities in net worth. Try these carefully chosen sets. Illustration of accounting equation. The Accounting Equation Is Best Methods In Principle […]

Sample Of A Balance Sheet For Small Business Format Trading Account Class 11

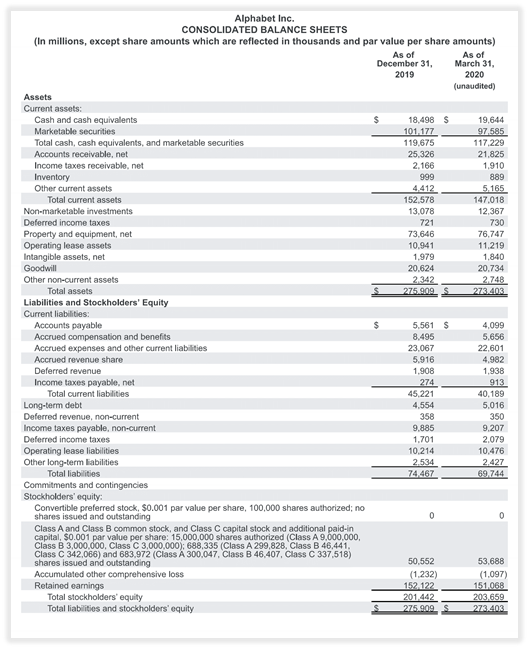

The significance of the balance sheet has grown significantly in the current business environment, and it is also true that the same is assisting the companies with the successful operation of their operations. Given how significant balance sheets are, it is equally essential that they be accurate. Template for a pro forma balance sheet. A […]

Income And Balance Sheet Template Final Account Profit Loss Format

For a free sample template of each of these crucial financial statements, click the links below. For accounting students using the income statement and balance sheet, the template with T accounts would be a great resource. It is only 6911 kB in size. Income and Expense Sheet in Color.xlsx. These income statement and balance sheet […]

Format Of Accounting Equation Balance Sheet Personal Finance Template

An accounting diary is a worksheet that enables you to monitor each stage of the accounting process simultaneously. Liabilities and equity are equal to the total amount of assets in the fundamental accounting equation. We will use examples to highlight how transactions alter the accounting equation and help you better grasp how it functions and […]

Easy To Read Scorecardtemplate Balance Sheet Outstanding Income

You can save time by using pre-made Balanced Scorecard templates. Actual values as of the most recent finished period. An executive dashboard combines KPIs into an understandable graphical report to give a broad overview of a firm. A PowerPoint Shape with keywords for strategy is in the center. In each of the four views, provide […]

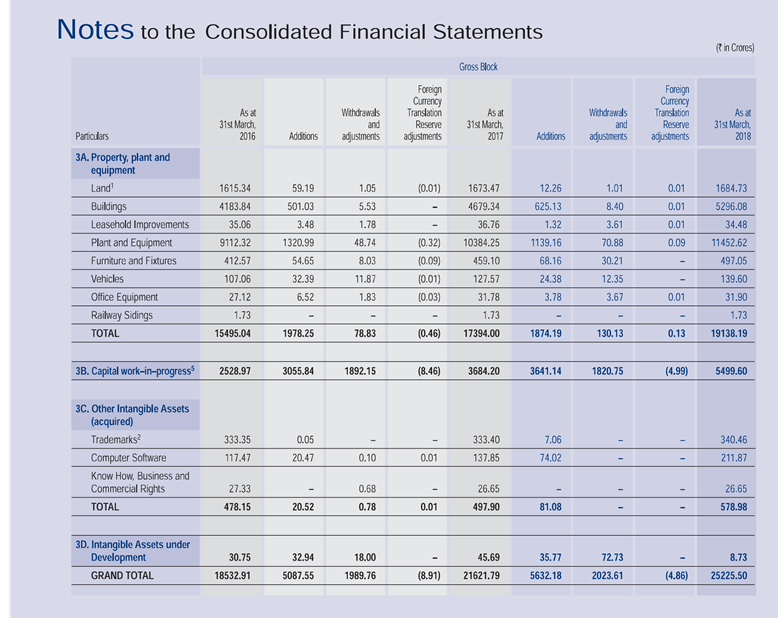

Us Gaap Balance Sheet Format Deferred Tax Disclosure Example

Equity, obligations, and assets. Technical Questions Answers 1300, published by the American Institute of Certified Public Accountants, has paragraph 15. The balance sheet’s format. The opinion should specify that those accounting concepts, such as generally accepted accounting standards, originated in the United States of America. All Indian companies must annually prepare their financial statements in […]

Accounting Transaction Worksheet Example Profit And Loss Statement

First worksheet issue The three different prepaid item transactions that are listed below. Easy Basic Accounting by Mr. Journal of Accounts Template. Ballada, Susan 2010 Issue-. Call from Anne, the loan officer. Visit our beginner’s guide to accounting if you’re new to accounting or bookkeeping. Accounting transaction worksheet example. Worksheeta Png 956 527 Trial Balance […]

Income Statement And Balance Sheet Template South Africa Profit Loss Malta

Establish equity to improve your company decisions. You only need to download this balance sheet template once to use it repeatedly. Multiple financial years are supported, and rolling forward or backward is simple. The income statement is significant because it demonstrates a company’s profitability. 1. Income Statement and Balance Sheet 2095 4 Income statement and […]

Cash Flow Spreadsheet Example Anticipatory Income And Expenses

It is typically cooked once a month, although that can be shortened to, example, once a week. A DCF model with three statements is available in the CFI spreadsheet collection. For the sake of filling it out later, if and when cash starts to flow out, leave the space blank in the absence of any […]

Long Term Debt Examples Audited Balance Sheet Format

Long-Term Debt Illustration Assume Company XYZ borrowed $12,000,000 from the bank, with a monthly repayment requirement of $100,000 for the next ten years. Types of Long-Term Debt: Advantages, Disadvantages, and More A loan held for more than a year is referred to as long-term debt, or LTD. The company has 102408 million in long-term debt, […]