Members of the profession have a bigger role and obligation in preparing for it because it’s a big step. to make preparing easier.

Norman Ralph Augustine CA. Additional advances and loans Disclosure made in accordance with Note No. Accordingly, Schedule VI shall be changed. Kantilal Patel Company compiled and prepared the document. One page of 23 Schedule VI of the Companies Act of 1956: a comparative analysis.

Schedule vi companies act 1956.

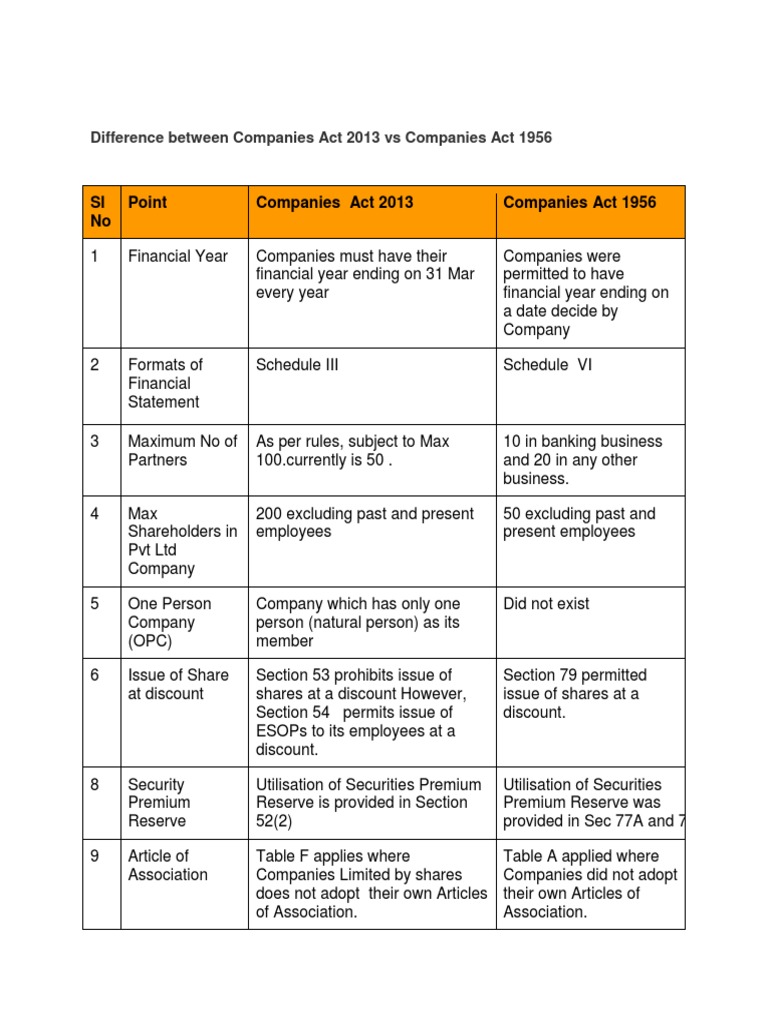

Difference Between Companies Act 2013 Vs 1956 Interest Securities Finance Balance Sheet Format Of Llp Free Template South Africa

RATE OF DEPRECIATION IN ACCORDANCE WITH SCHEDULE XIV OF THE COMPANIES ACT OF 1956, NATURE OF ASSETS WDV SLM 1 2 3 I. How to interpret specific phrases and words Company Act of 1956, Act No.

Particulars Rounding off of Figures in the Financial Statement in the Old Schedule VI and the Revised Schedule VI Every significant element, such as credits, receipts, and debits or expenses related to one-time or unusual transactions, must be less than Rs. B. less than Rs. but at least Rs. 100 Cr.

It is crucial to mention right away that, like its predecessor, Revised Schedule VI does not apply to banking or insurance organizations. Purely temporary constructions, such as wooden ones 100 100 II Single Shift. The table below provides a summary of the key differences between the old and new Schedule VI to the Companies Act of 1956 with regard to the profit and loss accounts. PART-C- Itemized Format of the Balance Sheet in the New Schedule VI to the Companies Act of 1956

Revisions to Companies Act of 1956 Schedule VI 1. All firms must now prepare their financial statements in accordance with the Revised Schedule VI to the Companies Act of 1956 starting on or after 14 November 2011. Turnover of Rs. 100 Crs – Roff to the nearest Hundreds of Thousands or Decimal thereof.

to make preparing easier. REQUIREMENTS FOR DISCLOSURE PURSUANT TO SCHEDULE VI PART II OF THE COMPANIES ACT 1956. Roff 500 Crs. to the nearest hundreds of thousands, lakhs, millions, or decimal thereof.

Members of the profession have a bigger role and obligation in preparing for it because it’s a big step. The provisions of the Companies Act of 1956 and the Accounting Standards will take precedence over the Revised Schedule VI. PLANT AND MACHINERY i. MAIN PRINCIPLES OF REVISED SCHEDULE VI

Old vs. 2011 revisions On March 1st, the Ministry of Corporate Affairs MCA published Schedule VI Revised. Companies must prepare their financial statements in accordance with the format specified in Revised Schedule VI, as per Section 2111 of the Companies Act of 1956. Short title, extent, and commencement 2.

Definitions of a public corporation, a private company, and an existing company 4. To find out the answer to your query, click here. According to Schedule VI of the Companies Act of 1956, the account for forfeited shares will be. I of 1 of 1956.

The requirements for disclosure set forth therein for inclusion on the face of the financial statements or in the notes are minimal requirements, according to Revised Schedule VI. The idea of is no longer present in the revised Schedule VI. The above-mentioned Schedules and any accompanying explanatory notes are a necessary component of the balance statement. The Schedules must include all the information specified in the A-Horizontal Form, together with notes that provide general guidance on how to prepare a balance sheet.

S of Schedule VI to the Companies, Part I. R.4 of Schedule VI’s Part I of the Companies Act of 1956 as of March 31. as of March 31. Long-Term Lending Contributions to Related Parties Directors Additional Company Officers Company in which a Director is a Partner member of a private company in which the director serves alone or collectively Note 19: Other Current Assets Disclosure Disclosure made in accordance with Note No. meaning of the terms holding corporation and 4A.

Single Shift 10 334 c. Revised Schedule VI to The Companies Act 1956 FACTORY BUILDINGS Concepts Features Disclosures What a new season or canvas is to an athlete or an artist, a revised schedule is to business. The disclosure obligations outlined in Parts I and II of this Schedule are in addition to, not in place of, the disclosure requirements outlined in the accounting standards as established by the Companies Act of 1956.

There is now a frame for the updated Schedule VI. SCHEMA IA See LIST OF RELATIVES, section 6c.